MARKET UPDATE

All eyes are on the Fed as we head into September. Most economists expect a 25-basis-point rate cut this month, which could stimulate both equity and fixed income markets in the short term, but critics argue that creating stimulus will only drive more inflation.

Overall economic growth continues to be a concern despite the upward revision to this quarter’s GDP report. Taking Q1 and Q2 together, they average just 1.4%, which is substantially below the generalized goal of 2%. The combination of tepid growth and rising inflation has reignited speculation that stagflation risks are looming, but the data doesn’t suggest we’re there just yet. Unemployment remains at a solid 4.2%, despite the jobs report that showed only 35,000 new jobs were created last month. As long as real wage growth outpaces inflation, we continue to see a “strong enough” jobs market that can keep the economy on track, especially if rate cuts can drive consumer spending.

One bright spot is the surge in AI spending, which is fueling a resurgence in manufacturing activity. Q2 saw the fastest growth in intellectual property spending in four years, and new orders even crossed into expansion territory for the first time in seven months.

Equity markets have pushed higher over the last month due to rate cut expectations and a decent earnings season, largely driven by technology companies and growth stocks. Although still a major consideration, the threat of tariffs has largely faded into the background as consumer sentiment has bounced back, and spending appears to be stabilizing. The same cannot be said for the bond market, which ended the month fairly flat on concerns that a quarter-point rate cut may not be enough to ease concerns about the state of the economy.

Overall, we continue to be net-positive on equity markets as we close out Q3

ADVISORS’ PERSPECTIVE

As of September, the U.S. economy shows an increasingly complex picture, with growth slowing even as inflation pressures remain a factor in policy decisions. August’s labor market data reinforced the perception of deceleration, with job growth falling well below expectations and prior months revised sharply lower, signaling that businesses are becoming more cautious in their hiring. The Federal Reserve has taken note of this cooling, and market consensus now anticipates the start of an interest rate-cutting cycle this month. The Fed has made it clear that any easing will be measured, emphasizing its intent to remain data-driven and avoid reigniting inflation, but the shift away from restrictive policy reflects growing concerns over weakening momentum.

The prolonged impact of tariffs continues to weigh heavily on the economic outlook. Multiple rounds of tariffs on imported goods, from industrial metals to consumer electronics, have driven costs higher for producers and households alike. The drag from these policies is increasingly embedded in supply chains, and many firms have shifted focus from absorbing price shocks to scaling back investments and projects. While inflation has moderated compared to its peak, the persistence of tariff-driven costs has eroded purchasing power, forcing businesses to reprice goods and leaving consumers feeling the pinch. Trade headlines, once market-moving, now receive less reaction, as “tariff fatigue” sets in among investors and consumers. The constant back-and-forth in trade negotiations has created an environment where uncertainty is simply expected, diminishing the political and economic impact of new announcements.

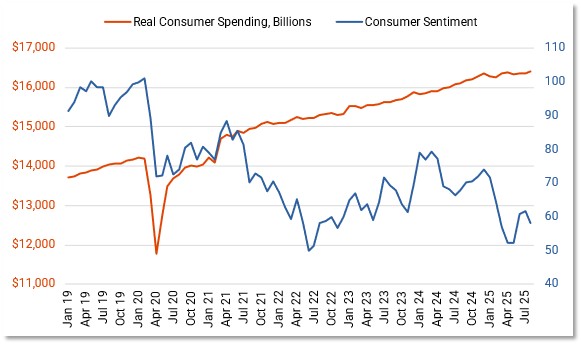

One of the most striking dynamics of this period is the divergence between consumer sentiment and spending.

Confidence Falls, Consumption Doesn’t – January 31, 2019 to August 31, 2025

As the chart illustrates, real consumer spending has steadily increased, reaching new highs over the last few quarters. However, consumer sentiment, which tends to anticipate shifts in behavior, has trended downward since 2021, hitting multi-year lows earlier this year. This disconnect suggests that while households are still spending, much of that spending may be driven by necessity, debt, or delayed purchases rather than confidence in the future. Retailers are reporting softness in discretionary categories, while essentials and services hold steady, reflecting a cautious consumer base. If sentiment remains weak, spending growth may eventually follow suit, posing a challenge for policymakers trying to engineer a soft landing.

The Federal Reserve is attempting to strike a careful balance in its communication. Officials have signaled that they see room to cut rates to support growth without fully abandoning inflation vigilance. Market participants widely expect a 25-basis-point cut at the September meeting, with some speculation of a larger move, though Fed leaders emphasize the importance of pacing. While the economy is not yet in recession, leading indicators such as the flattening yield curve, slowing business investment, and declining manufacturing activity point to growing risks in 2026 if consumer spending softens further.

Equity markets have responded positively to the prospect of lower interest rates, though gains are tempered by uncertainty over earnings. Corporate profit margins are under pressure, squeezed by higher input costs, wage growth, and weaker pricing power in some sectors. Fixed income markets, meanwhile, have rallied, reflecting investor expectations for an extended easing cycle and concerns over the durability of economic growth.

Overall, the economic narrative as of early September is defined by caution. The Fed’s shift toward easing represents recognition that conditions have deteriorated faster than anticipated, but policymakers are treading carefully to avoid reigniting inflation. Tariffs continue to distort pricing and sentiment, even as they become a less dominant driver of market swings. Consumer behavior remains a crucial variable, with strong spending masking deep pessimism reflected in sentiment surveys. This divergence, highlighted by the chart, underscores the fragility of the current expansion: while the consumer is still driving growth, confidence has eroded, and policymakers are racing to adjust before slowing demand becomes self-reinforcing.

DISCLOSURE

This update is not intended to be relied upon as forecast, research, or investment advice, and is not a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Hilltop Wealth & Tax Solutions to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecast made will materialize. Additional information about Hilltop Wealth Solutions is available in its current disclosure documents, Form ADV, Form ADV Part 2A Brochure, and Client Relationship Summary Report, which are accessible online via the SEC’s Investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using SEC # 801-115255. Hilltop Wealth Solutions is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting, or tax advice.