MARKET UPDATE

U.S. equity markets delivered a mixed but generally positive performance in the second half of January, with major indices posting modest gains for the month. Interestingly, equities were far less volatile than other asset classes in the second half of January, while precious metals, currencies, and commodities saw sharp swings. Gold surged to a record before plunging on January 30 in its largest single-day decline since the 1980s. The dollar posted its steepest slide since April’s tariff-driven turmoil amid speculation about intervention to support the Japanese yen, while oil climbed to its highest level since August. Yet the Volatility Index (VIX) remained below its one-year average, suggesting equity market volatility was concentrated at the single-stock level, driven by earnings reactions rather than broader macroeconomic concerns.

The Federal Reserve held its benchmark rate unchanged at 3.5%–3.75% at its January meeting, following three consecutive rate cuts in the second half of 2025. Fed Chair Powell noted that economic activity continues to expand at a solid pace, though inflation remains somewhat elevated near 3%. Markets anticipate one to two additional quarter-point rate cuts by year-end. Adding to the week’s developments, President Trump nominated former Fed Governor Kevin Warsh to succeed Powell as chair when his term expires in May, news that helped lift the dollar. Warsh, who served on the Federal Reserve Board from 2006 to 2011, faces Senate confirmation amid questions about central bank independence. While historically hawkish on monetary policy, his recent statements suggest alignment with Trump’s preference for lower rates.

Four Magnificent Seven companies reported earnings, with the results underscoring a widening divergence: companies demonstrating clear AI monetization are rewarded, while those still in heavy investment phases face investor skepticism. S&P 500 earnings are tracking 11.8% higher year-over-year, marking the fifth consecutive quarter of double-digit growth. Looking ahead, the confirmation process for the incoming Fed chair and further corporate earnings reports will likely shape market direction in the coming weeks.

The bottom line: Despite crosscurrents from mixed earnings results and shifting Federal Reserve leadership dynamics, equity markets demonstrated resilience through January. Strong performances from Apple and Meta offset Microsoft’s disappointment, while the Fed’s decision to pause rate cuts provided near-term clarity on monetary policy. Consumer sentiment improved modestly, suggesting households are gradually adjusting to current conditions even as elevated prices and labor market concerns persist. Rich valuations and pockets of sector-specific weakness still bear watching. Even so, stable policy, solid fundamentals, and improving market breadth provide a foundation for continued progress.

ADVISORS PERSPECTIVE

January unfolded as a month defined by transition, as markets worked to reconcile evolving monetary leadership, moderating economic momentum, and a shifting earnings backdrop. Early-year optimism gradually gave way to a more nuanced tone, with investors balancing resilient corporate fundamentals against rising policy uncertainty and uneven economic data. While risk appetite remained present, it became increasingly selective, favoring areas supported by tangible earnings strength and reasonable valuations rather than broad-based enthusiasm. Throughout the month, the investment landscape reflected a market that was constructive but attentive to developing crosscurrents.

A key contributor to that more cautious posture was rising policy uncertainty following the announcement of a new Federal Reserve Chair. While the overall policy direction is expected to remain broadly consistent, questions around the future pace of rate cuts and the Fed’s tolerance for renewed inflation pressures introduced additional uncertainty. Even subtle shifts in messaging have contributed to increased volatility in interest rates and pockets of the equity market, reinforcing a more measured investor stance.

At the economic level, signs of moderation are becoming more evident, particularly within the labor market. While headline employment data continues to suggest overall stability, younger workers are facing increasing challenges. Hiring activity for early-career positions has softened, job searches are taking longer, and wage growth among younger cohorts has slowed. These trends suggest that the effects of tighter financial conditions are being felt unevenly, with more vulnerable segments showing stress first. While this does not yet signal a broad-based slowdown, it reinforces the view that economic growth is gradually cooling rather than reaccelerating.

Corporate earnings have remained a key source of support for equities. Several of the largest technology companies reported results during the period, highlighting an evolving dynamic within market leadership. Companies able to clearly articulate and demonstrate tangible returns on artificial intelligence investments were rewarded, while those still heavily focused on spending and development without visible near-term benefits faced more muted or negative reactions.

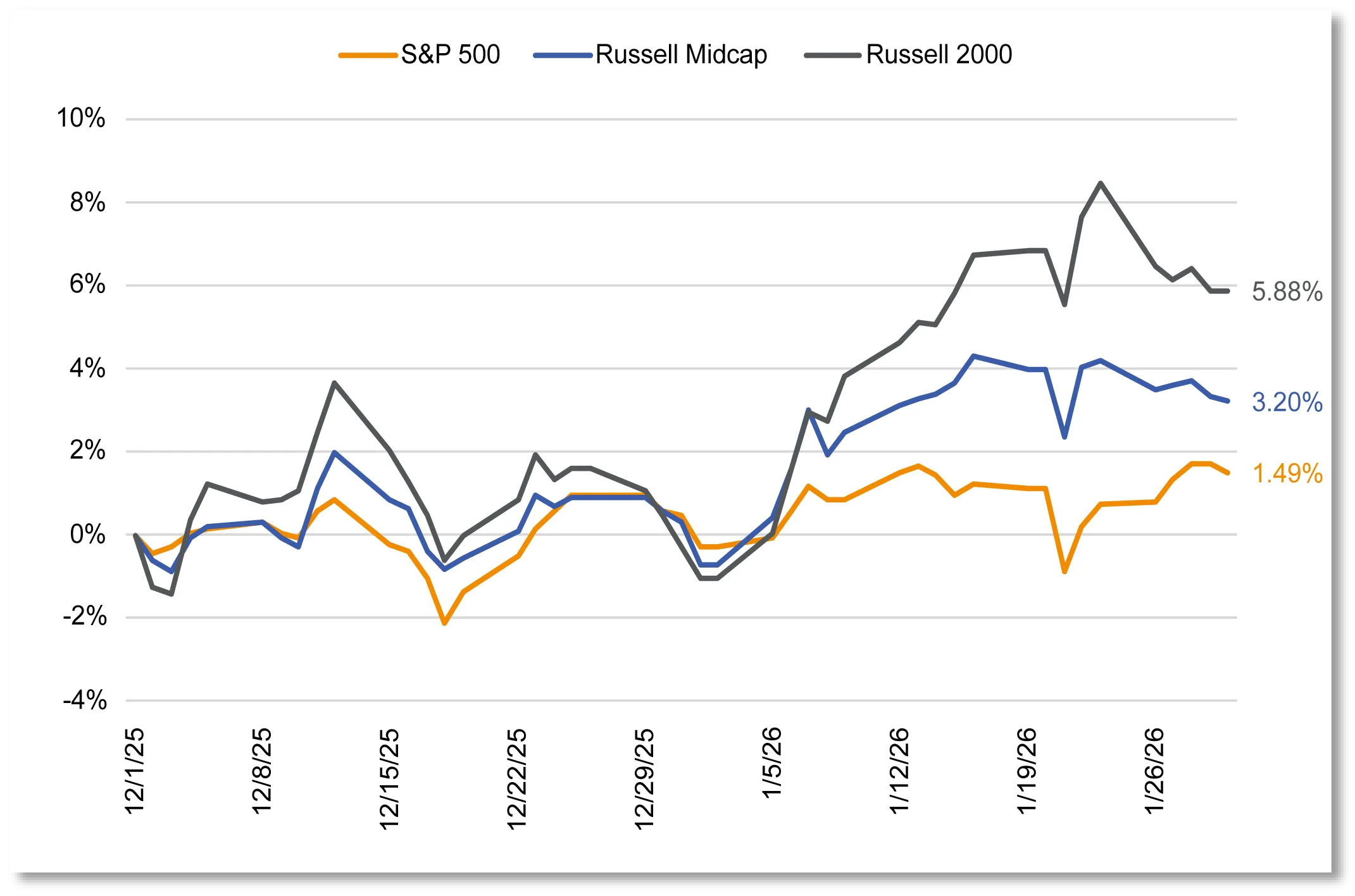

As illustrated in the chart above, investor positioning has begun to shift. After an extended period dominated by large-cap stocks, recent performance reflects a noticeable rotation into small- and mid-cap companies. More attractive valuations, improving earnings prospects, and the expectation that these segments may benefit more meaningfully as monetary policy gradually eases have all contributed to this trend. While leadership remains fluid, the broadening of participation is generally viewed as a constructive development for market durability.

This shift in market leadership is being reinforced at the earnings level. The earnings premium that once defined the Magnificent Seven has narrowed meaningfully as the benefits of artificial intelligence adoption diffuse across the broader market. The earnings growth gap compressed sharply from approximately 41 percentage points in the first quarter of 2025 to near parity by the third quarter, driven by a moderation in Mag 7 growth alongside accelerating earnings across the rest of the S&P 500. Importantly, this convergence should be viewed as healthy rather than bearish, as markets reliant on a narrow group of stocks tend to be more fragile, while broad-based earnings growth reflects a maturing and more sustainable AI-driven cycle. While the Magnificent Seven are still expected to deliver faster earnings growth—with consensus estimates calling for roughly 20% growth in 2026 compared to approximately 12% for the S&P 493—the premium continues to shrink, suggesting that the remainder of the market is increasingly participating in earnings growth rather than large-cap leaders materially slowing.

Overall, the investment environment as of January 31 supports a cautiously constructive outlook. Economic growth remains positive, earnings momentum is intact, and the policy backdrop is slowly becoming more accommodative. At the same time, lingering inflation pressures, emerging labor market softness, particularly among younger workers, and uncertainty surrounding future Federal Reserve leadership argue for restraint. Markets appear willing to advance, but investors remain mindful that the balance between opportunity and risk remains delicate as these crosscurrents continue to unfold.

This update is not intended to be relied upon as forecast, research, or investment advice, and is not a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Hilltop Wealth & Tax Solutions to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecast made will materialize. Additional information about Hilltop Wealth Solutions is available in its current disclosure documents, Form ADV, Form ADV Part 2A Brochure, and Client Relationship Summary Report, which are accessible online via the SEC’s Investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using SEC # 801-115255. Hilltop Wealth Solutions is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting, or tax advice.